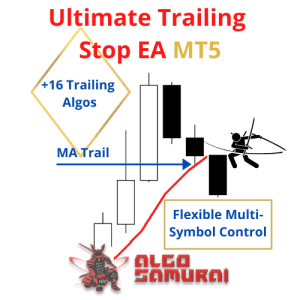

Ultimate Trailing Stop EA

Original price was: $100.00.$89.00Current price is: $89.00.

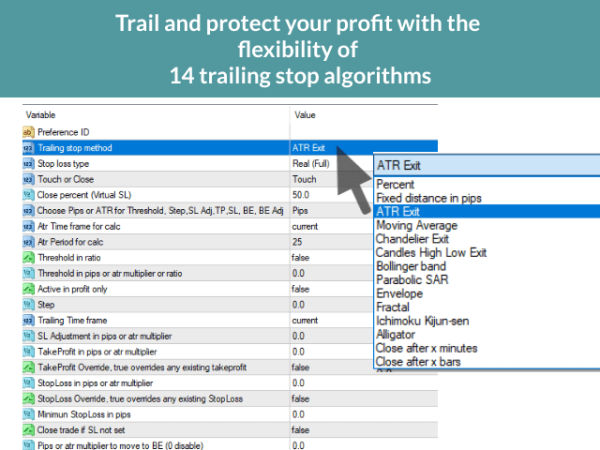

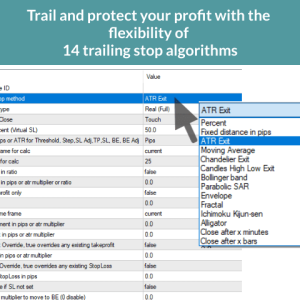

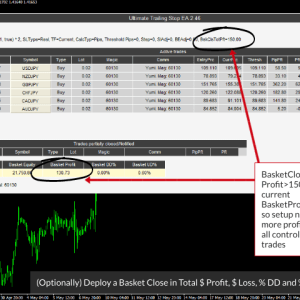

This EA Utility allows you to manage (with advanced filtering) unlimited open orders (manual or EA) with 16 trailing stop methods: fixed, percent, ATR Exit, Chandelier Exit, Moving Average, Candle High Low Exit, Bollinger Bands, Parabolic, Envelope, Fractal, Ichimoku Kijun-Sen, Alligator, Exit After X Minutes or Bars, RSI and Stochastic. The trailing stop can be either real or virtual, and you can exit fully or with a partial close percent on touch or bar close.

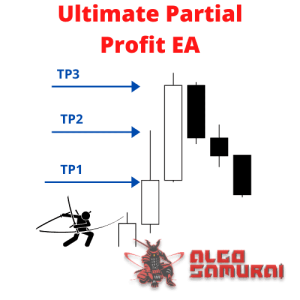

Moreover, you can add (override) stop loss, take profit and breakeven, add three partial take profit levels, and manage basket close in total dollar profit or loss, and/or percent drawdown or up draw.

| Platform: MT4 | |

| Price: Lifetime Unlimited Use |

Free shipping on orders over $50!

- Satisfaction Guaranteed

- No Hassle Refunds

- Secure Payments

Product Description

This EA Utility allows you to manage (with advanced filtering) unlimited open orders (manual or EA) with 16 trailing stop methods: fixed, percent, ATR Exit, Chandelier Exit, Moving Average, Candle High Low Exit, Bollinger Bands, Parabolic, Envelope, Fractal, Ichimoku Kijun-Sen, Alligator, Exit After X Minutes or Bars, RSI and Stochastic. The trailing stop can be either real or virtual, and you can exit fully or with a partial close percent on touch or bar close.

Moreover, you can add (override) stop loss, take profit and breakeven, add three partial take profit levels, and manage basket close in total dollar profit or loss, and/or percent drawdown or up draw.

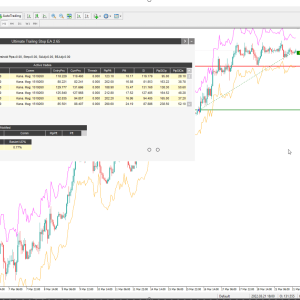

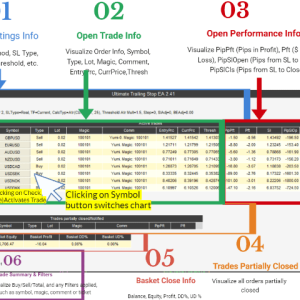

Visualize all orders and their trailing stop levels in a beautiful trade control panel.

Visualize trailing SL (and open price & TP) on chart, and deploy mini trade panel for fast partial closing and order info.

Why the need for a good trailing stop system?

If you do a Google search, you will find “Trailing Stop” brings up 832,000 results, which is significant, and “Trailing Stop” MT4 brings up 200,000 results, a rather large number for the niche platform of MT4.

Trailing stops are sought out because markets are volatile, and your profitable open trade of today can easily turn into a losing trade tomorrow in a quickly vacillating market. A trailing stop follows the price when moving in favor of the trade and doesn’t require human interaction. Its main power is limiting losses and securing profits.

Most trailing stops out there are classified as simple trailing stop systems that protect a fixed pip or percentage of the open trade profit, and some follow a single indicator.

This utility can be best classified as an All-In-One or Universal Trailing Stop system because it allows for the following of multiple indicators in addition to a fixed or percent trail. But even in this upper classification, it stands out from the competition.

What makes Ultimate Trailing Stop EA unique?

- Automatically trail your open positions using one 14 trailing algorithms.

- Choose between a real or virtual trailing stop, and get out fully or partial percent, on bar touch or bar close.

- Manage unlimited open orders (manual or EA) of different symbols on same chart.

- Filter open orders based on symbol, magic number, comment, or ticket.

- Display all controlled orders in an advanced display showing each trade’s open trade info and their trailing stop levels, along with dynamically updating pips to level, pips & dollar profit.

- [NEW] Visualize indicators on chart, along with open order arrows, pip & profit visual tracking.

- [NEW] Visualize trailing SL (and open price & TP) on chart, and deploy trade panel for fast partial closing and order info.

- [NEW] Added partial profit close levels (3 levels) in two modes, by pips and by percent of profit.

- [NEW] Added check (uncheck) boxes to open trades in Controlled Trades Display to allow for automatic (manual) trailing stop activation.

- [NEW] Added two new exit methods, Close After X Minutes and Close After X Bars.

- [NEW] Basket Close in Total $ Profit | Total $ Loss | % Drawdown | % Updraw

***** Please view/vote/suggest future features/improvements/ideas of UTS in the roadmap *****

Additional Information

| Platform | MT4 |

|---|---|

| Price | Lifetime Unlimited Use |

Reviews

There are no reviews yet.